2025 South Africa Minimum Wage Increase – Simplify Payroll with Agrigistics

4 min read

The South African National Minimum Wage (NMW) is set to increase from R27.58 to R28.79 per hour from 1 March 2025. This 4.4% increase is part of the government’s annual wage adjustment to align worker earnings with inflation while ensuring business sustainability.

For industries like agriculture, manufacturing, and construction, this change is particularly significant, affecting payroll budgets, workforce planning, and compliance requirements. Employers in these sectors must prepare for the financial impact while ensuring accurate payroll processes to remain compliant.

Historical Trends in Minimum Wage

Understanding how the national minimum wage has changed over the years provides context for the 2025 increase. Below is a historical overview:

.png)

This steady upward trend highlights the progression of wage regulations in South Africa and underscores the need for businesses to adapt payroll strategies accordingly.

What’s Changing?

The new minimum wage of R28.79 per hour applies to all workers in South Africa, including farm and domestic workers. The adjustment follows the recommendation of the National Minimum Wage Commission, which based its proposal on:

- Consumer Price Index (CPI) + 1.5% (November 2024 CPI recorded at 2.9%)

- Inflation and cost of living adjustments

- Economic conditions, productivity, and employment rates

- Public and business sector input

The only exception to this rate applies to the Expanded Public Works Programme (EPWP), where workers will receive a lower rate of R15.83 per hour.

How This Impacts Businesses in Agriculture, Manufacturing, and Construction

1. Increased Labour Costs

For businesses with large workforces—especially those in labour-intensive industries like agriculture, manufacturing, and construction—this increase means higher payroll expenses. If not managed efficiently, these rising costs could squeeze profit margins and lead to increased pricing pressure.

👉 Solution: Employers need precise time and attendance tracking to avoid overpayments and ensure fair, compliant payroll calculations.

2. Compliance Risks & Payroll Adjustments

Failing to adjust wages before 1 March 2025 can lead to non-compliance penalties, disputes, and potential legal issues. One of the most significant challenges businesses face is determining how many hours worked should be calculated at the old rate versus the new rate. This becomes particularly complex in shift-based environments, where employees' working hours cross over the transition period. Even a small discrepancy in these calculations can lead to thousands in unexpected wage adjustments for businesses with large workforces.

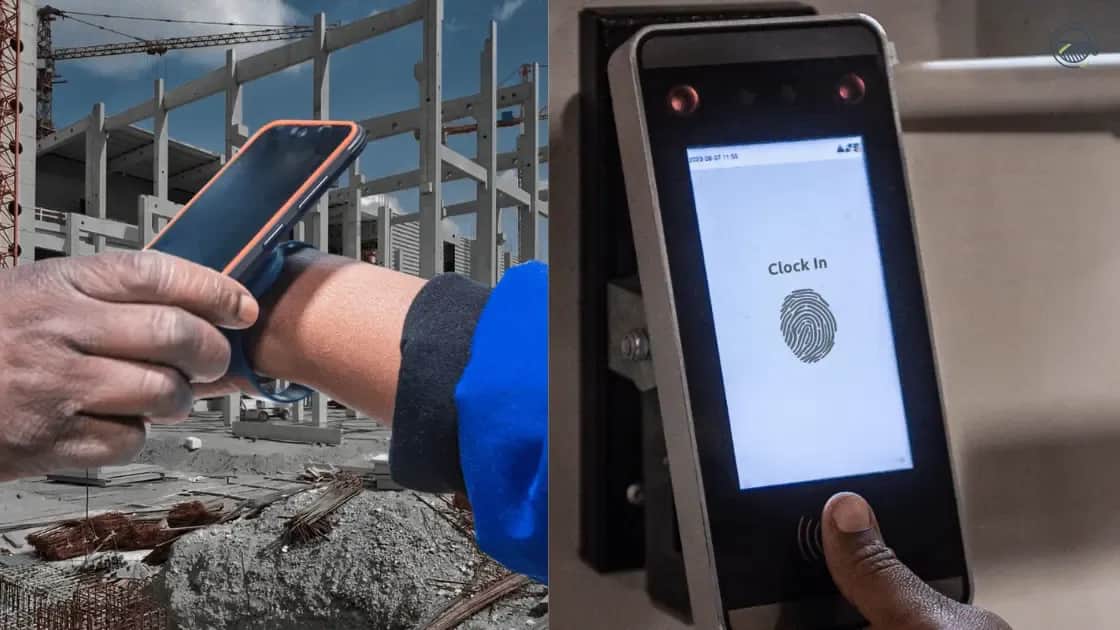

👉 Solution: Agrigistics automates payroll adjustments, enabling businesses to change a single variable to account for the rate increase. The system seamlessly applies the correct pay rate for hours worked before and after the increase, reducing manual calculations and preventing costly errors. With biometric and RFID clocking, every shift is logged in real time, ensuring accurate payroll processing and full compliance—no manual tracking required.

3. Workforce Management & Operational Planning

With higher wage bills, businesses must evaluate how they manage shifts, overtime, and staffing levels. Ensuring accurate records of employee hours is crucial to prevent unnecessary costs.

👉 Solution: Real-time clocking data provides employers with full visibility into labour expenses, helping them make smarter workforce decisions and reduce wasteful spending. With a workforce of 1,000 employees, even a small payroll miscalculation can have a significant financial impact. Agrigistics ensures accuracy, giving businesses confidence that every payroll cycle is correct and compliant.

Industry-Specific Challenges and Responses

Agriculture: Wage Increase Amid Economic Pressure

According to Agri SA, the wage increase is a double-edged sword for the agricultural sector.

Johann Kotzé, CEO of Agri SA, stated:

“This increase aims to safeguard farm workers’ livelihoods while ensuring the long-term sustainability and competitiveness of our sector.”

Key Challenges for Farmers:

- Agricultural GDP shrank by 5% in 2024 due to severe droughts and fluctuating input costs.

- Many farms already operate on tight profit margins, making wage hikes a significant financial strain.

- Rural job creation remains critical, yet increasing wages could force some farms to reduce their workforce.

However, experts, including the Bureau for Food and Agricultural Policy (BFAP), predict that the sector could see a 3.5% rebound in 2025 if weather conditions normalise.

Manufacturing: Managing Labour Costs in a Competitive Market

- Wage increases will put additional pressure on already strained supply chains.

- Automation and optimised shift management can help sustain profitability.

- Smart payroll solutions enable businesses to control costs while maintaining compliance.

Construction: Project Budgets and Compliance Risks

- Contractors must adjust project budgets to accommodate higher wage costs.

- Accurate time tracking and job costing is essential to prevent unexpected expenses.

- Maintaining compliance with government regulations is crucial to avoid fines or legal action.

What Employers Should Do Now

With the deadline approaching, businesses need to act fast to ensure compliance and manage payroll adjustments efficiently.

✅ Steps to Prepare:

✔ Review payroll structures – Ensure wages reflect the new R28.79 per hour requirement from 1 March 2025.

✔ Audit time tracking systems – Reduce payroll discrepancies and avoid overpayment.

✔ Automate payroll calculations – Use Time & Attendance and Payroll integration to eliminate errors.

✔ Educate management teams – Train HR and payroll staff on new wage structures.

✔ Plan for cost adjustments – Reassess budgets to accommodate the increase.

Make Compliance Easy with Agrigistics

Managing payroll with ever-changing regulations doesn’t have to be complicated. Agrigistics automates time tracking and payroll processes, ensuring error-free compliance with the new minimum wage laws—without the stress.

🔹 Track hours in real time – Get accurate wage calculations with accurate Time & Attendance.

🔹 Eliminate payroll errors – Ensure employees are paid correctly with integrated Payroll, reducing disputes and compliance risks.

🔹 Stay 100% compliant – Avoid penalties and last-minute wage adjustments.

🔹Make changes with the click of a button - Update hourly rates as well as the dates that they should be implemented.

⏳ Don’t wait until the deadline. Make the switch today and stay ahead of future minimum wage changes.

Final Thoughts

The 2025 National Minimum Wage increase has a crucial impact for South African businesses, requiring proactive payroll adjustments and strategic workforce management. By adopting smart payroll solutions, companies can maintain compliance, control costs, and focus on growth.

With March 1 fast approaching, now is the time to future-proof your payroll and simplify wage compliance with Agrigistics.

💡 Need help? Let’s make this transition seamless.

.png&w=1920&q=65)

.png&w=1920&q=65)